FREQUENTLY ASKED QUESTIONS

CLICK ON LINKS TO THE LEFT, UNDER HEADLINES TO NAVIGATE TO BOND TOPICS

1. WHAT IS A BOND?

A bond is similar to a home mortgage. It is a contract to repay borrowed money with an interest rate over time. Bonds are sold by a school district to competing lenders to raise funds to pay for the costs of construction, renovations and equipment.

2. WHY DO SCHOOL DISTRICTS NEED TO SELL BONDS?

Most school districts in Texas utilize bonds to finance renovations and new facilities. The district does not receive any money from the state for the construction of new school buildings or improvements. This bond would allow the district to finance improvements and new schools without needing to cut regular budget items like school programs, teachers and staff. Since school buildings sometimes serve the community for 50 or more years, it is well reasoned that taxpayers would pay for them over a period of 25 to 30 years and not from the district's annual operating budget.

3. HOW CAN BOND FUNDS BE USED?

Bond funds can be used to pay for new buildings, additions and renovations to existing facilities, land acquisition, technology infrastructure and equipment for new or existing buildings and large-ticket items such as school buses. Bonds cannot be used for salaries or operating costs such as utility bills, supplies, building maintenance, fuel and insurance.

4. WHAT IS A BOND ELECTION?

School districts are required by state law to ask voters for permission to sell bonds to investors in order to raise the capital dollars required to renovate existing buildings or build a new school. Essentially, it’s permission to take out a loan to build, renovate and pay that loan back over an extended period of time, much like a family takes out a mortgage loan for their home. A school board calls a bond election so voters can decide whether or not they want to pay for proposed facility projects.

5. EXACTLY HOW MUCH IS THE DISTRICT ASKING FOR IN THIS BOND ELECTION?

The district is calling a bond with one proposition. Proposition One is for a total of $18,700,000.

6. HOW WAS THE BOND PACKAGE DEVELOPED?

Working with the Board of Trustees, teachers, and administrators from across the district, the facilities committee developed a list of requested items to consider for inclusion in a 2017 bond package. Danbury ISD has been evaluating current facilities and equipment, ongoing enrollment growth, and district priorities with the Board of Trustees to collectively compile a list of items that reflect responsible stewardship and a forward-thinking mindset.

7. HOW IS THE DISTRICT'S TAX RATE CONFIGURED?

A school district’s tax rate is comprised of two components: the Maintenance & Operations tax (M&O) and the Interest & Sinking tax (I&S). The M&O rate is used to operate the school district, including salaries, utilities, furniture, supplies, food, gas, etc. The I&S rate is used to pay off school construction bonds. Bond sales only affect the I&S rate.

DANBURY ISD CURRENT TAX RATE:

DANBURY ISD PROJECTED TAX RATE:

8. HOW WILL THE BOND IMPACT HOMEOWNER TAXES?

The average home in Danbury ISD is valued at $156,853 before exemptions. This amount is highlighted in red in the chart below:

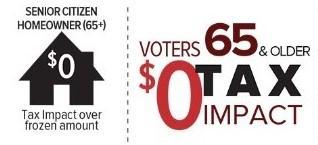

9. HOW WILL THE BOND IMPACT TAXPAYERS 65 OR OLDER?

Under state law, the dollar amount of school taxes imposed on the residence homestead of a person 65 years of age or older cannot be increased above the amount paid in the first year after a person turns 65 or is disabled. This rate stays in effect regardless of changes in tax rate or property value, unless there are new improvements to the homestead that increase the value of the home. You must apply for this exemption.

10. WHAT ARE THE BOND COST QUICK FACTS?

11. IF THE BOND PASSES, WHEN WOULD MY TAXES GO UP?

If the bond passes, the bonds would most likely be sold at the beginning of the year to capitalize on lower interest rates. The taxes for the 2017-18 school year have already been set by the Board of Trustees. The next opportunity to raise taxes will be at the August meeting of the Board of Trustees at the beginning of the 2018-19 school year.